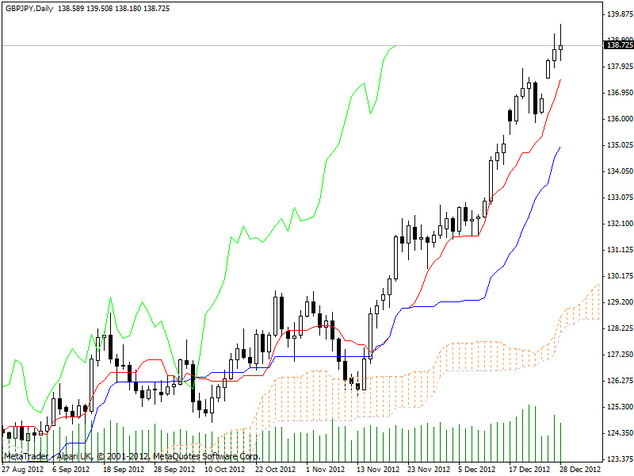

A mini update today as I am off on a short new years break returning the 3rd. GBP/JPY opened a bit lower at 138.714 and at the time of writing (13:00 GMT) a bullish candle is forming and the price is at 139.259, representing a gain of 3,644 pips at around 4 GBP on my 5 lots purchased.

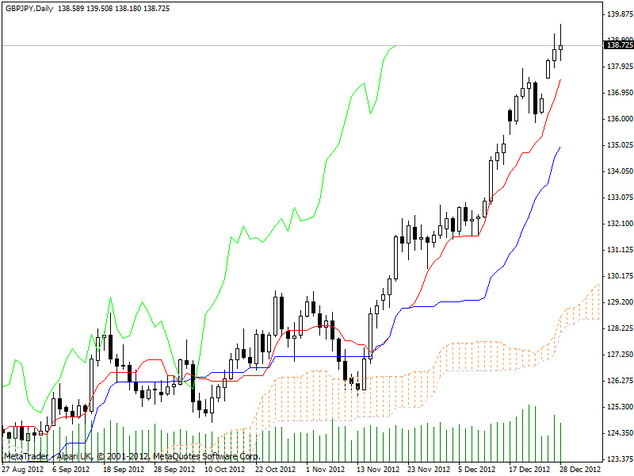

It is worth noting that the Kijun Sen is starting to flatten out but for now I am still bullish on the GBP/JPY.

Happy trading and have a happy new year everyone!

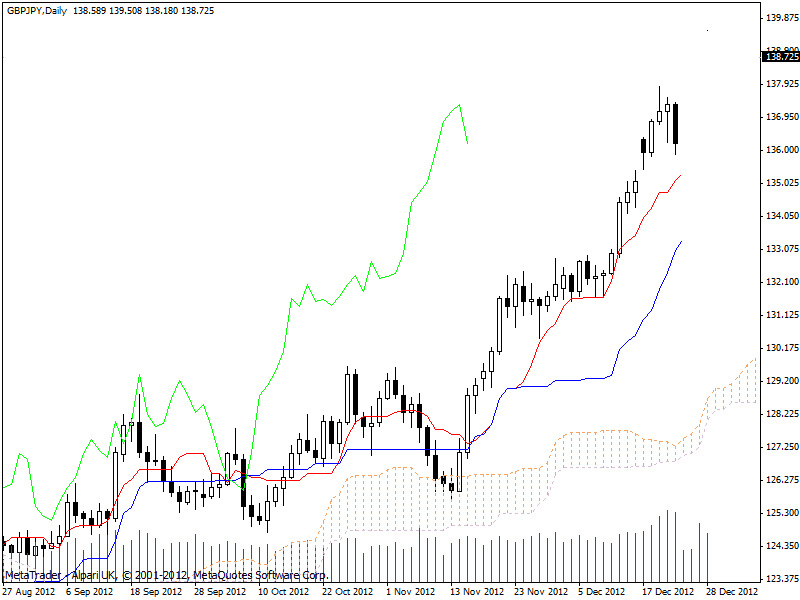

To recap, on 17th December I entered a long trade on the GBP/JPY at 135.615. This shortened week over the xmas period saw further bullish development as anticipated:

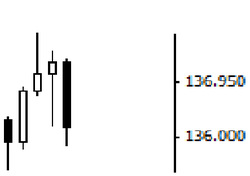

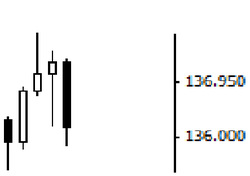

24th December saw the pair recover and close to 136.744 leaving us with a bullish Harami pattern, denoting further upwards extention for this pair.

26th December saw significant gains and new highs closing at 138.159 leaving a nice bullish candle. Gains were extended futher on the 27th and 28th reaching highs of 139.508 before closing at 138.725.

The end of the week draws and I am still in profit to the tune of 3,110 pips (138.725 - 135.615) at approx 4 GBP per pip.

The candle on the 28th is almost a Doji and shows a lot of bearish pressure. Reaction and analysis in general from "the herd" (twitter, forexpros etc) is that 140.000 will present a challange and sellers are already gearing up to attempt to pick a top and make gains on the way down.

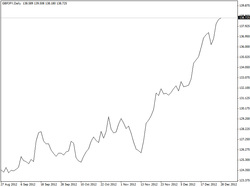

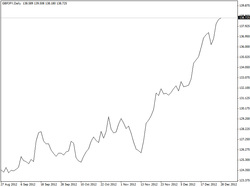

On a weekly Ichimoku chart one can see that the pair has not reached these levels since April 2011 and that the scene is clearly bullish. However, on the monthly ichimoku chart the scene is long term bearish still but a bullish tenkan-sen/kijun-sen cross has occurred as and this is generally considered to be a weak signal when occuring beneath the cloud. My (perhaps contrarian) view is that this weak signal may well be weak for the monthly time frame but perhaps not for the weekly and dailys, as is confirmed in my mind from the analysis of those particular charts. I am cautious of the 140.00 but this has been tested once before and it is often the case that a second test fairs better. Nay-sayers are quick to forecast the demise of the pound yen and I do expect to see some bearish volume over the coming week.

To protect my gains I am moving my stop to 137.500 but I remain bullish on the pair awaiting the close of the next candle.

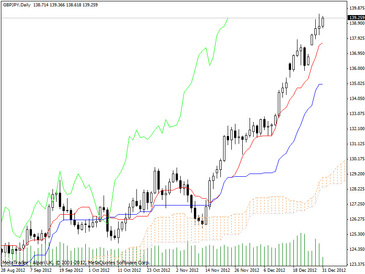

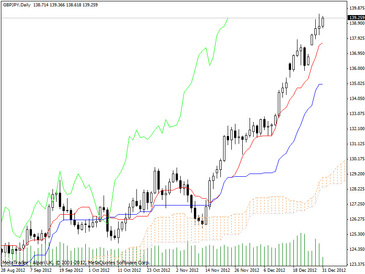

Daily Ichimoku Chart: GBP/JPY

A lot has happened since the 17th December where I went long on a bounce off the 135/6 area at 135.615 with a target view of taking profit at the 136.300 resistance.

17th December saw a bullish rise to a high of 136.770 before dipping to its close of 135.927. Although my target profit had been achieved I did not take profit but instead decided to see what the next candle would reveal. Bearing in mind the bullish picture of the daily Icimoku chart and the index analysis conducted previously I believed there could be much further on the upside, perhaps even a test of my next resistance level of 137.600.

18th December revealed a bullish engulfing pattern fueling my decision to remain in the trade. The pair hit a high of 136.913 before closing at 136.831.

19th December saw the pair reach new highs of 137.860, breaching the next level of resistance refered to above. The candle closed as a shooting star, denoting potential for reversal. Other than this one indication as all other signs are bullish, I again awaited the next candle.

20th December revealed a bearish hanging man and a low of 136.217. I considered the dow theory that a lower low would need to appear before this showed a reversal in the trend and plotted the chart below. All lows to this point have been higher lows and point to an uptrend, as does the Ichimoku chart.

21st December revealed a bearish engulfing almost bearish marabozu candle hitting a low of 135.886 before closing at 136.196. I interpret this move as a return to the trendline and not a sign of overall bearishness, remember that Ichimoku is bullish and overall the pound is doing very well against the yen.

And so the week ends with some gains wiped but in profit to the tune of 581 (136.196-135.615) at approx 4 GBP to the pip. Risk was initially 5% of captial but stop loss has been moved to break even to protect against bearish development. Happy to be in a risk free and insofar profitable trade.

My outlook remains bullish on the GBP/JPY.

Looking at the hourly currency index I can see continued weakening of the JPY against the GBP. Naturally I will be seeking to make trades against the yen by going bullish on the GBP/JPY pair.

Looking at the hourly charts there appears to be some near support around the Kijun-Sen at 135.32 and again around 135.45. On Mondays 15m chart we see some range bound price action. I will be seeking to go long on a bounce off the 135.000 area with a target of 136.300.

RSS Feed

RSS Feed