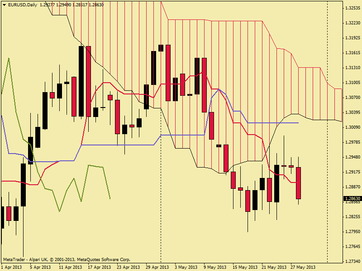

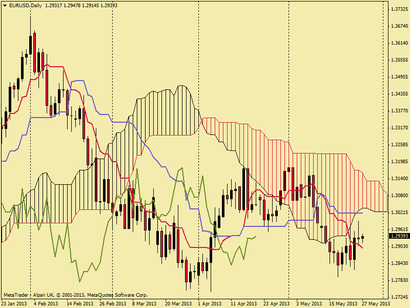

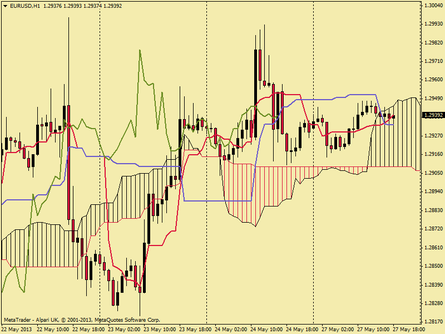

Yesterday I posted an outlook which was fundamentally bearish whilst price action remains beneath the cloud base. I also posted a perspective on the battle between dollar strength and euro recovery in as much that the clear winner would be the dollar.

Todays candle (most recent in the chart to the left) was indeed very bearish largely due to a rise in US consumer confidence. The Consumer Confidence released by the Conference Board captures the level of confidence that individuals have in economic activity. A high level of consumer confidence stimulates economic expansion while a low level drives to economic downturn. Generally, a high reading is also positive for the USD, while a low reading is negative.

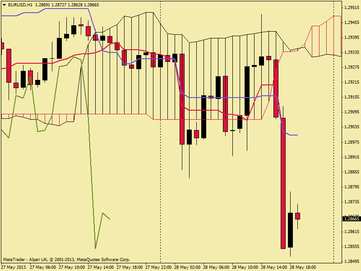

Today's release revised last months figure from 68.1 to 69 and gave a figure of 76.2 against an anticipated 70 and dollar strength increased because of this and moved the EUR/USD to todays low of 1.28517, from a high of 1.29490. At the time of writing the pair has risen slightly to 1.28691. The hourly chart (below right) shows the intraday movements in more detail.

Todays candle (most recent in the chart to the left) was indeed very bearish largely due to a rise in US consumer confidence. The Consumer Confidence released by the Conference Board captures the level of confidence that individuals have in economic activity. A high level of consumer confidence stimulates economic expansion while a low level drives to economic downturn. Generally, a high reading is also positive for the USD, while a low reading is negative.

Today's release revised last months figure from 68.1 to 69 and gave a figure of 76.2 against an anticipated 70 and dollar strength increased because of this and moved the EUR/USD to todays low of 1.28517, from a high of 1.29490. At the time of writing the pair has risen slightly to 1.28691. The hourly chart (below right) shows the intraday movements in more detail.

US Consumer Confidence rose to 76.2 against an expected 70. Aprils figure was revised up 0.9 points to 69

In todays trading I was happily short from 1.29438 and profited from today's release.

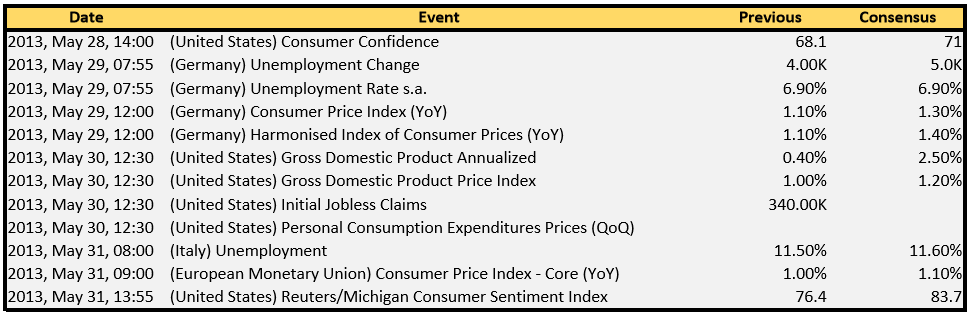

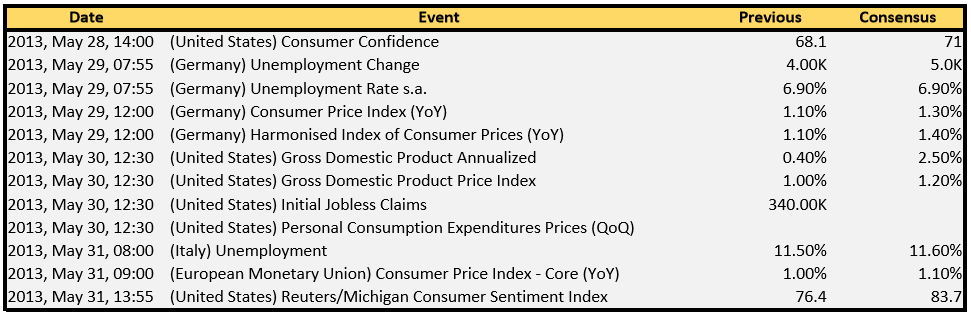

Tomorrow sees a burst of high impact data releases from Germany in respect of unemployment and CPI.

See my economic calendar below for more info. Needless to say, worse than expected data will be a further bearish driver which could eliminate any gains the pair makes overnight during the Asian session.

Better than expected data, however, could push price higher to test the daily tankan sen, currently at 1.3000.

Whilst still being bearish on the pair now is not the time to be placing further shorts ahead of this data.

Should I decide to trade tomorrows releases it will be with a lesser risk and I may adopt straddle entries in order to capture an either/or trade in the resulting direction which currently is a little unpredictable and volatile.

Tomorrow sees a burst of high impact data releases from Germany in respect of unemployment and CPI.

See my economic calendar below for more info. Needless to say, worse than expected data will be a further bearish driver which could eliminate any gains the pair makes overnight during the Asian session.

Better than expected data, however, could push price higher to test the daily tankan sen, currently at 1.3000.

Whilst still being bearish on the pair now is not the time to be placing further shorts ahead of this data.

Should I decide to trade tomorrows releases it will be with a lesser risk and I may adopt straddle entries in order to capture an either/or trade in the resulting direction which currently is a little unpredictable and volatile.

RSS Feed

RSS Feed