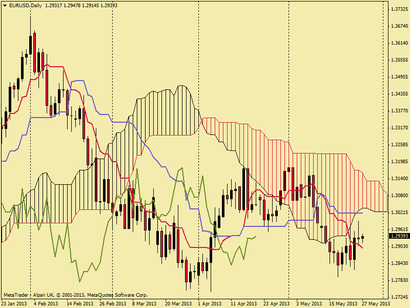

The chart to the left shows daily EUR/USD price action. As you can see, the theme has been somewhat bearish, and continues to be so as price remains beneath the cloud.

In recent weeks there have been recoveries back to the 1.30 zone but overall price has failed to breach the cloud to the other side.

Until price attacks the cloud base again, I'm going to remain bearish on this pair.

In recent weeks there have been recoveries back to the 1.30 zone but overall price has failed to breach the cloud to the other side.

Until price attacks the cloud base again, I'm going to remain bearish on this pair.

".... a fundamentally bearish outlook as dollar strength has yet to be pacified, only extremely good news from the Eurozone will manage to dent the advances of the greenback ... "

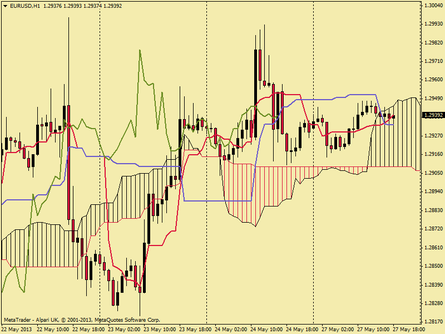

The hourly chart to the right shows the battles that have been fought as the pair has attempted recovery.

Again I reiterate that the bulls are only here for the short term and I anticipate shorting once price breaches the cloud base (1.29067) again.

My trading style and strategy is very short term and essentially relies on a 5 five minute kijun sen crossing an hourly kijun sen in the direction of the bias set by the daily and hourly charts.

Its a moving average crossover - with ichimoku flavouring, one that I believe presents high probability set ups in trending markets.

Again I reiterate that the bulls are only here for the short term and I anticipate shorting once price breaches the cloud base (1.29067) again.

My trading style and strategy is very short term and essentially relies on a 5 five minute kijun sen crossing an hourly kijun sen in the direction of the bias set by the daily and hourly charts.

Its a moving average crossover - with ichimoku flavouring, one that I believe presents high probability set ups in trending markets.

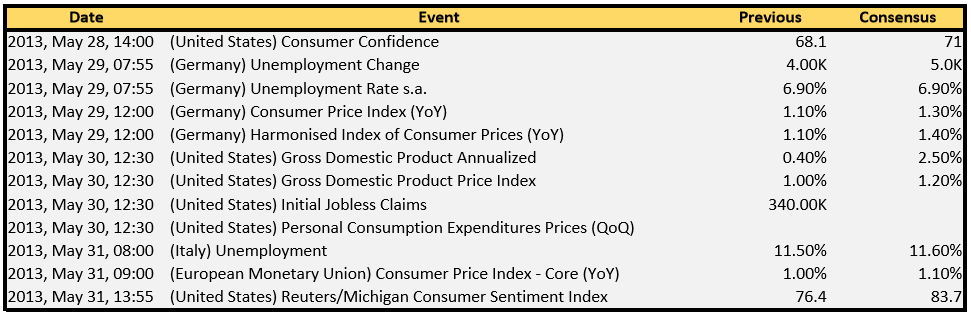

I also trade the news, but generally in bias with the rest of my strategy and this week has plenty of high impact releases, as the table below indicates. I look forward to review this pair again next week to see if I was anywhere near right! In the meantime some further reading in support of my view that the only winner of this battle will be the USD.

http://www.fxstreet.com/news/forex-news/article.aspx?storyid=86d3ae47-ce68-4c5f-883b-4653c08112bd

http://www.forexstreet.net/profiles/blogs/td-securities-eur-usd-short-term-trend-remains-lower-key-weekly-s

http://www.efxnews.com/story/18954/ecb-wont-be-pacifist-currency-war-so-where-does-leave-eurusd-hsbc

http://www.fxstreet.com/news/forex-news/article.aspx?storyid=86d3ae47-ce68-4c5f-883b-4653c08112bd

http://www.forexstreet.net/profiles/blogs/td-securities-eur-usd-short-term-trend-remains-lower-key-weekly-s

http://www.efxnews.com/story/18954/ecb-wont-be-pacifist-currency-war-so-where-does-leave-eurusd-hsbc

RSS Feed

RSS Feed