For today, a bearish candle, a lesson on the Tenkan Sen and a thank you....

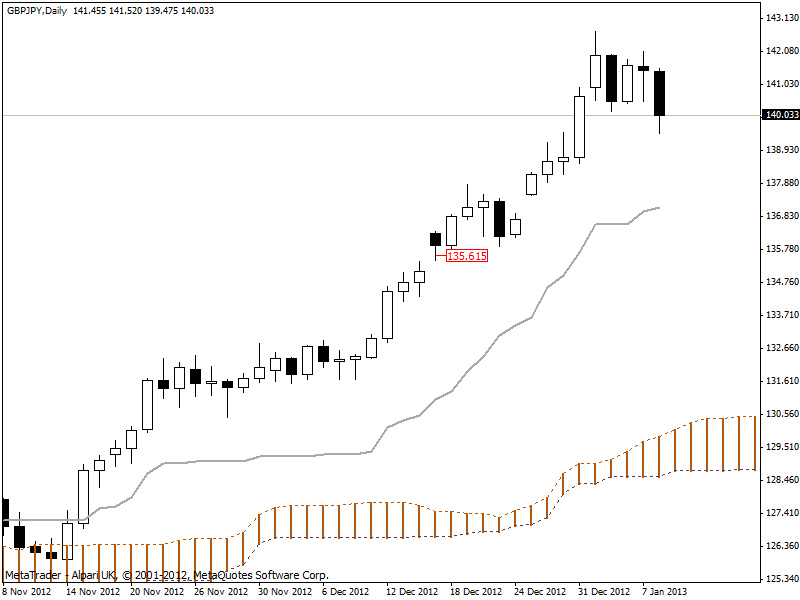

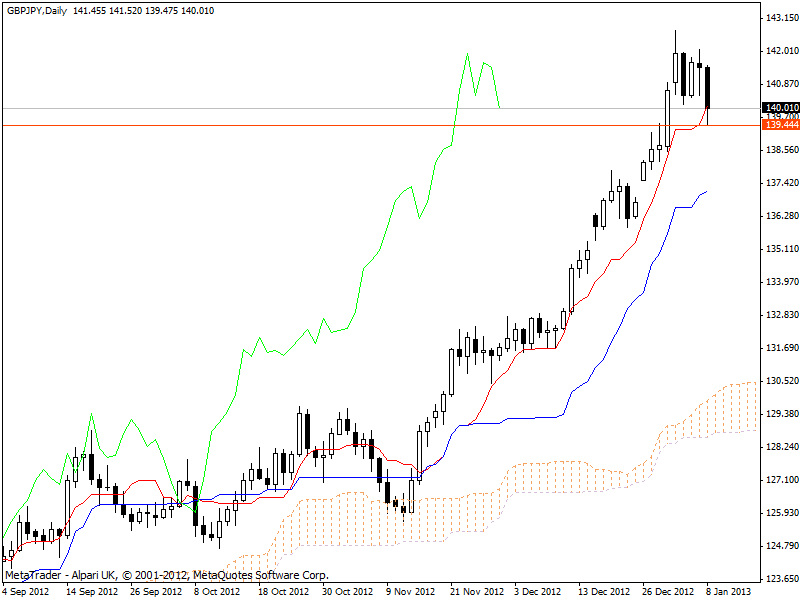

Today my gains took a bit of a battering as bears pushed price action further down. Remember yesterday I set my stop to the closing tenkan sen of 139.444? Well todays low got pretty close to it at 139.475. This shows just how important the Tenkan Sen is as a short term support and resistance value. My trade is still alive, but only just.

As Ichimoku traders will know, when price crosses the Tenkan Sen it is a major accomplishment because it has broken a major short term support/resistance value. During a trend, if price action crosses the Tenkan Sen it can indicate one of three different scenarios:

1. Minor Short-Term Pull Back: A minor short term pull back is where price crosses over the Tenkan Sen but never crosses over the Kijun Sen and later resumes on the path of the original trend and this usually happens when short term traders take profit. The long term traders continue to hold their current position.

2. Major Short-Term Pull Back: A major pull back will have price crossing both the Tenkan Sen and Kijun Sen in the opposite direction of the trend. Once it has done that, price eventually continues on the original path crossing them both again. In this scenario, long term position traders are taking some profits, They are not closing out their position at all because they believe the instrument will continue the trend after the major pull back has finished.

3. Countertrend: The third scenario is similar to the second scenario where price crosses over both the Tenkan Sen and the Kijun Sen. The crossover takes place in the opposite direction of the trend. However, the majoy trend never resumes. Either the instrument (currency pair in this case) enters a consolidation pattern (sideways) or a new trend forms. In this scenario, the long term traders are exiting their positions completely. They can do so over a certain time period or all at once in some cases.

Price currently has not fully crossed at a close but it may well happen. I would hope that price is just returning to equilibrium with the Tenkan Sen and at worst we are experiencing a minor short term pull back. I did predict a bounce from the 139.000 area so at this stage I am prepared for my stop to be hit soon as per my prediction and as well that it may be the Tenkan Sen value I used as my stop is not strong enough to support price action any further. Nonetheless I am still enjoying a highly profitable run from my 135.615 buy order. Price at the time of writing is 140.033 and I am looking forward to seeing what tomorrows candle brings.

Happy trading and as a foot note I would like to thank all visitors for thier support and interest, I have noted that views are increasing daily and a further thank you for the 400+ who have taken it once stage further and are now following me on twitter.

Today my gains took a bit of a battering as bears pushed price action further down. Remember yesterday I set my stop to the closing tenkan sen of 139.444? Well todays low got pretty close to it at 139.475. This shows just how important the Tenkan Sen is as a short term support and resistance value. My trade is still alive, but only just.

As Ichimoku traders will know, when price crosses the Tenkan Sen it is a major accomplishment because it has broken a major short term support/resistance value. During a trend, if price action crosses the Tenkan Sen it can indicate one of three different scenarios:

1. Minor Short-Term Pull Back: A minor short term pull back is where price crosses over the Tenkan Sen but never crosses over the Kijun Sen and later resumes on the path of the original trend and this usually happens when short term traders take profit. The long term traders continue to hold their current position.

2. Major Short-Term Pull Back: A major pull back will have price crossing both the Tenkan Sen and Kijun Sen in the opposite direction of the trend. Once it has done that, price eventually continues on the original path crossing them both again. In this scenario, long term position traders are taking some profits, They are not closing out their position at all because they believe the instrument will continue the trend after the major pull back has finished.

3. Countertrend: The third scenario is similar to the second scenario where price crosses over both the Tenkan Sen and the Kijun Sen. The crossover takes place in the opposite direction of the trend. However, the majoy trend never resumes. Either the instrument (currency pair in this case) enters a consolidation pattern (sideways) or a new trend forms. In this scenario, the long term traders are exiting their positions completely. They can do so over a certain time period or all at once in some cases.

Price currently has not fully crossed at a close but it may well happen. I would hope that price is just returning to equilibrium with the Tenkan Sen and at worst we are experiencing a minor short term pull back. I did predict a bounce from the 139.000 area so at this stage I am prepared for my stop to be hit soon as per my prediction and as well that it may be the Tenkan Sen value I used as my stop is not strong enough to support price action any further. Nonetheless I am still enjoying a highly profitable run from my 135.615 buy order. Price at the time of writing is 140.033 and I am looking forward to seeing what tomorrows candle brings.

Happy trading and as a foot note I would like to thank all visitors for thier support and interest, I have noted that views are increasing daily and a further thank you for the 400+ who have taken it once stage further and are now following me on twitter.

still profitable from a buy at 135.615 but cashing up time could come soon

RSS Feed

RSS Feed