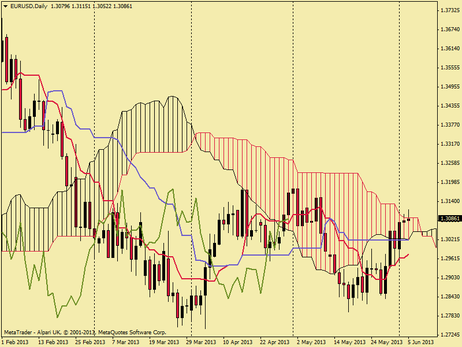

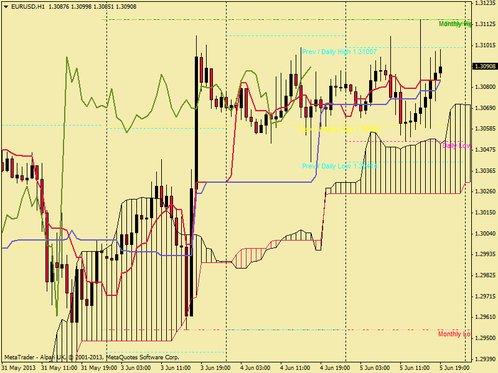

Bullish ventures continued today with the EUR/USD hitting highs of 1.31150 testing and piercing the top of the daily cloud before being driven southward again.

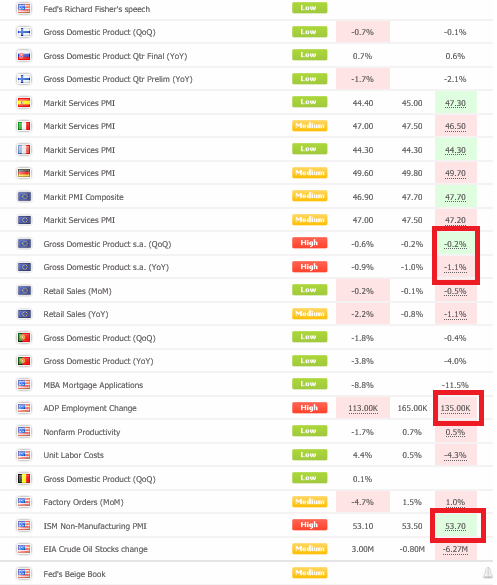

I said yesterday that I would be watching three things, and that I most certainly did. Firstly Eurozone GDP data was released. To be honest it was a bit of a mixed bag with the Quarterly figure as expected at -0.2% and the Annual slightly worse than expected at -1.1% verses -1.0%. It did drive the EUR/USD down to its daily low of 1.30922 but the data for me was too wishy washy for me to commit to a trade.

I said yesterday that I would be watching three things, and that I most certainly did. Firstly Eurozone GDP data was released. To be honest it was a bit of a mixed bag with the Quarterly figure as expected at -0.2% and the Annual slightly worse than expected at -1.1% verses -1.0%. It did drive the EUR/USD down to its daily low of 1.30922 but the data for me was too wishy washy for me to commit to a trade.

Eurozone GDP was a mixed bag, however U.S ADP Employment Change fell short of its 165k target by 30k

The next release was far more interesting. The Employment Change released by the Automatic Data Processing, Inc is a measure of the change in the number of employed people in the United States. Generally speaking, a rise in this indicator has positive implications for consumer spending which stimulates economic growth. Generally speaking, a high reading is seen as positive, or bullish for the USD, while a low reading is

seen as negative, or bearish.

The actual figure was 135,000, against an expected 165,000. I had buy stop and sell stop entry orders straddled either side of the range and thus a the buy stop was triggered at 1.30800. The movement extended the days high up to 1.31150 and this trade provided the bulk of the days profits. Next came the ISM non-manufacturing PMI data, and whilst being better than expected, this didn't stop the market from going against it to attempt another test of the highs, which is where my remaining profit was generated today.

The pair seems unable to breach the 1.31 handle for long enough to extend its bullish runs up to the 1.32 handle, eyes are firmly on tomorrows European interest rate decision, policy statement and press conference as well as United States initial jobless claims and a speech by the Federal Reserve member Sarah Bloom Raskin. It could look to be a choppy day with break-outs, fake-outs and waiting around in the meantime. A lot of the data is happening all at once so tight stops and extra caution to be employed. Furthermore, a view is being generated that Fridays all important Non-Farm Payroll figures will miss expectations and thus push the EUR/USD upwards. Hit or miss, there is going to be a lot of action before the week closes.

Happy Trading!

seen as negative, or bearish.

The actual figure was 135,000, against an expected 165,000. I had buy stop and sell stop entry orders straddled either side of the range and thus a the buy stop was triggered at 1.30800. The movement extended the days high up to 1.31150 and this trade provided the bulk of the days profits. Next came the ISM non-manufacturing PMI data, and whilst being better than expected, this didn't stop the market from going against it to attempt another test of the highs, which is where my remaining profit was generated today.

The pair seems unable to breach the 1.31 handle for long enough to extend its bullish runs up to the 1.32 handle, eyes are firmly on tomorrows European interest rate decision, policy statement and press conference as well as United States initial jobless claims and a speech by the Federal Reserve member Sarah Bloom Raskin. It could look to be a choppy day with break-outs, fake-outs and waiting around in the meantime. A lot of the data is happening all at once so tight stops and extra caution to be employed. Furthermore, a view is being generated that Fridays all important Non-Farm Payroll figures will miss expectations and thus push the EUR/USD upwards. Hit or miss, there is going to be a lot of action before the week closes.

Happy Trading!

A view is being circulated that Fridays Non-Farm Payroll will fall short of expectations...

RSS Feed

RSS Feed