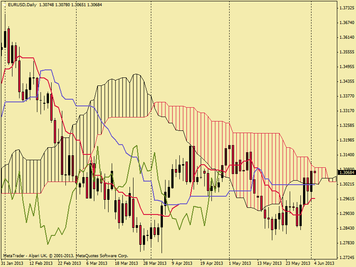

In my last update, I was fundamentally bearish on the EUR/USD and, in the long term, I still am. In the short term however I am more cautious with this view as economic data has propelled price action into the daily cloud (figure left). A sustainable break out of the cloud could well be a game changer but personally its going to take a lot for me to drop my bias towards dollar strength.

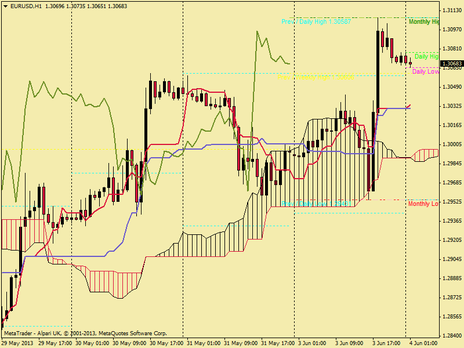

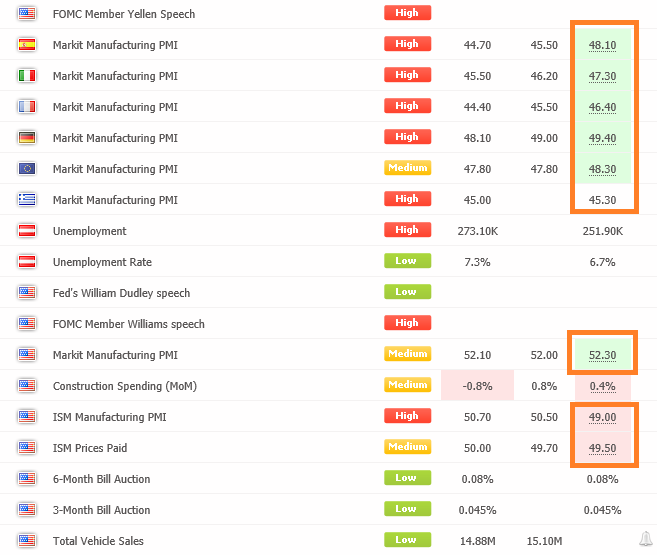

In the first trading day of the month, price opened at 1.29925 and rose on the back of Eurozone PMI data, detailed below, to a high of 1.30427.

The good data was swiftly forgotten by the markets upon the release of US market manufacturing PMI data which was better than expected and the pair subsequently dropped beyond its opening to a low of 1.29545.

Then along came the big movement of the day. ISM Manufacturing PMI.

In the first trading day of the month, price opened at 1.29925 and rose on the back of Eurozone PMI data, detailed below, to a high of 1.30427.

The good data was swiftly forgotten by the markets upon the release of US market manufacturing PMI data which was better than expected and the pair subsequently dropped beyond its opening to a low of 1.29545.

Then along came the big movement of the day. ISM Manufacturing PMI.

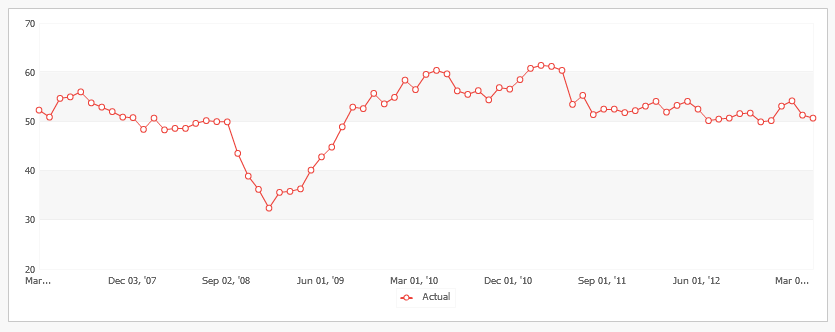

The Institute for Supply Management (ISM) Manufacturing Index shows business conditions in the US manufacturing sector. It is a significant indicator of the overall economic condition in US. A result above 50 is seen as positive (or bullish) for the USD, whereas a result below 50

is seen as negative (or bearish).

Todays result was 49 against an expect 50.50, both lesser than expected and in bearish territory. The result was a massive leap from the low of 1.29545 to a high of 1.31069. I was fortunate to have been long from a 1.29800 trigger.

Below, I have included a historical ISM PMI chart which shows the significance of todays release, as the last below 50 release was December 2012 (at 49.9), and before that, August 2009, (48.9).

is seen as negative (or bearish).

Todays result was 49 against an expect 50.50, both lesser than expected and in bearish territory. The result was a massive leap from the low of 1.29545 to a high of 1.31069. I was fortunate to have been long from a 1.29800 trigger.

Below, I have included a historical ISM PMI chart which shows the significance of todays release, as the last below 50 release was December 2012 (at 49.9), and before that, August 2009, (48.9).

US ISM Manufacturing PMI result was 49 against an expected 50.50, lesser than expected and in bearish territory, a massive leap followed. 1.31069 highs.

So where does this leave us? Clearly there has been an immediate bullish influence, which may well continue into the week or it might be a little over cooked and the downtrend will again resume. Tomorrow I will be very cautious in my trading using tight stops but I will be eyeing two things:

1. Spain - Unemployment Change. The monthly survey which details how many people were added during the previous month. Usually the figure is gloomy and has no impact on the Euro but this time may be an exception as Spanish PM Rajoy has released a thick hint to “watch the employment numbers on Tuesday”.

2. United States - Trade balance. The Trade Balance released by the Bureau of Economic

Analysis and the U.S. Census Bureau is a balance between exports and imports of total goods and services. A positive

value shows trade surplus, while a negative value shows trade deficit. It is an event that generates some volatility for the USD. If a steady demand in exchange for US exports is seen, that would turn into a positive growth in the trade

balance, and that should be positive for the USD.

Happy Trading!

1. Spain - Unemployment Change. The monthly survey which details how many people were added during the previous month. Usually the figure is gloomy and has no impact on the Euro but this time may be an exception as Spanish PM Rajoy has released a thick hint to “watch the employment numbers on Tuesday”.

2. United States - Trade balance. The Trade Balance released by the Bureau of Economic

Analysis and the U.S. Census Bureau is a balance between exports and imports of total goods and services. A positive

value shows trade surplus, while a negative value shows trade deficit. It is an event that generates some volatility for the USD. If a steady demand in exchange for US exports is seen, that would turn into a positive growth in the trade

balance, and that should be positive for the USD.

Happy Trading!

RSS Feed

RSS Feed